As sports betting continues to gain traction across the United States, more Americans are placing wagers on their favorite teams and events—sometimes even turning a profit. But while the excitement of winning a bet is undeniable, many bettors overlook one crucial aspect of their newfound hobby: taxes. Whether you’re betting casually or as a serious...

HomeCategoryBlog Archives - IRS Rewards

Taxes in the United States can be confusing—especially as new forms of income continue to emerge in the digital world. From freelance gigs and cryptocurrency trades to YouTube revenue and even online gambling, today’s taxpayers need to stay alert and informed. What Makes the U.S. Tax System Unique? The United States taxes individuals on their...

Online poker has become a popular form of entertainment and income in the United States. With platforms offering competitive games, tournaments, and real money prizes, many players are now wondering how their winnings are treated by the Internal Revenue Service (IRS). Whether you’re a recreational player or a professional grinder, understanding your tax obligations is...

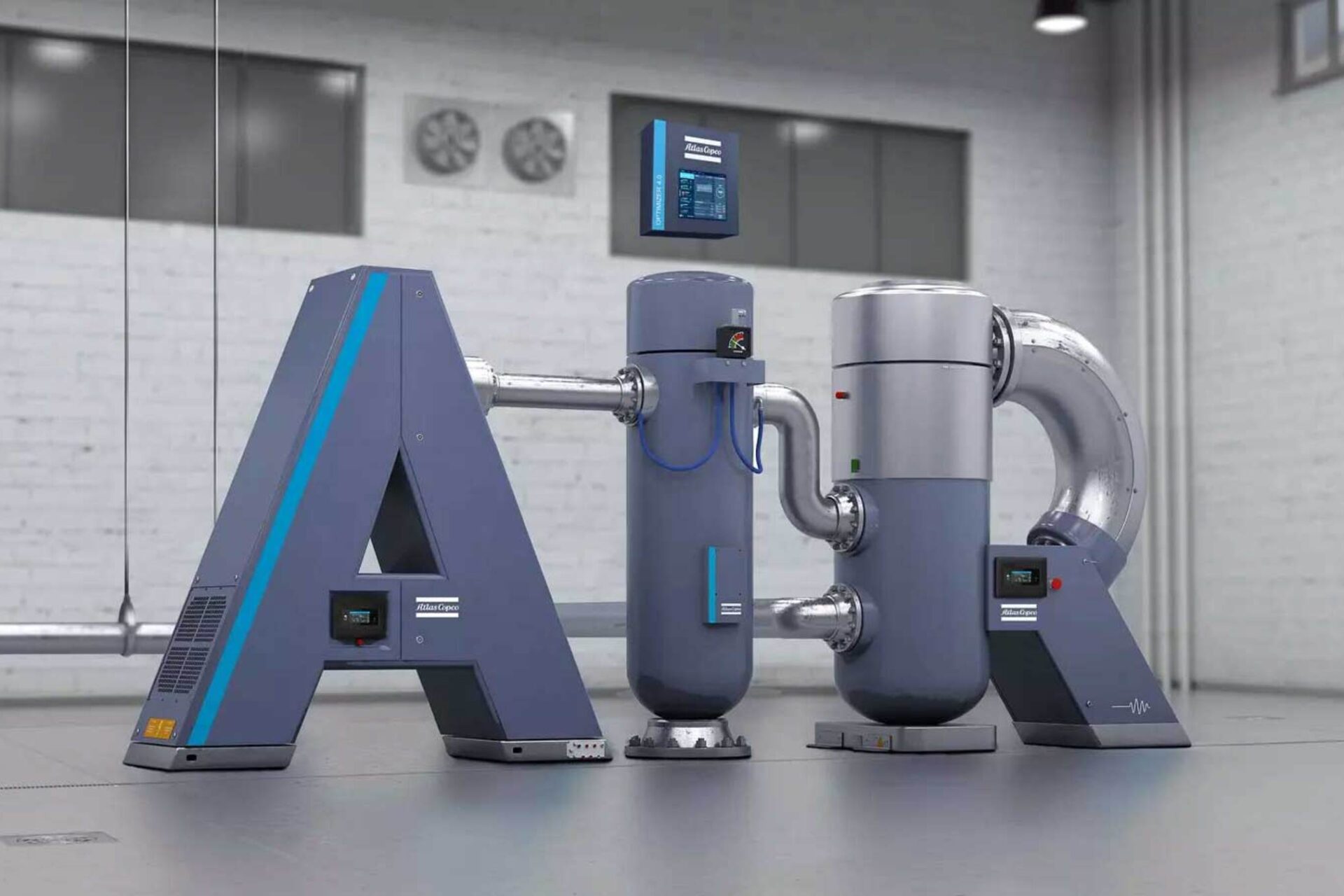

Product Range and Application Areas Atlas Copco is a global leader in industrial solutions, known for its innovative and energy-efficient equipment. The brand offers a wide spectrum of products including air compressors, vacuum solutions, generators, pumps, and power tools. These products are used across various industries such as automotive, food processing, electronics, construction, and pharmaceuticals....

As the global tech and innovation sector rapidly approaches the $10 trillion mark, investors worldwide are searching for high-growth opportunities that offer both stability and scalability. Enter MOZG (Mercury of Zero Gravity Innovative Industries) — a visionary platform committed to opening the doors of this massive market to investors of all sizes. Whether you’re an...

Real estate transactions are among the most significant financial decisions an individual or business can make. Whether you’re buying, selling, or investing in property, understanding the tax implications is crucial. Various taxes come into play depending on the nature of the transaction, including capital gains tax, property tax, and transfer taxes. Staying informed about these...

Exploring Opportunities in Dubai’s Thriving Sectors Dubai is renowned for being one of the most business-friendly cities in the world, offering a dynamic environment for entrepreneurs. The city’s booming economy, strategic location, and world-class infrastructure make it an ideal place to start a business. Whether you’re looking to invest in real estate, technology, hospitality, or...

The Origins of Loose Diamonds Diamonds, formed deep within the Earth’s mantle under immense heat and pressure, have existed for billions of years. However, the first recorded discovery of diamonds dates back to India around 4th century BC, where they were found in rivers and streams. For centuries, India was the world’s primary source of...

How Loose Diamonds Are Mined Diamonds, formed over billions of years deep within the Earth’s mantle, are brought to the surface through volcanic eruptions. These precious stones are mined from two primary sources: kimberlite pipes and alluvial deposits. Kimberlite pipes are deep volcanic channels where diamonds are embedded in volcanic rock. Miners extract these stones...

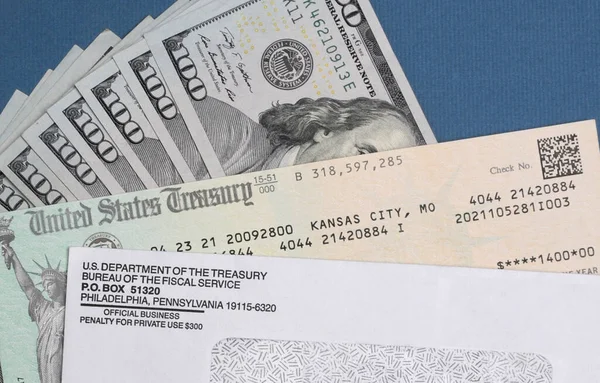

Tax compliance is crucial for the proper functioning of any economy. Reporting tax violations helps ensure that businesses and individuals contribute their fair share to the public coffers, which in turn supports public services and infrastructure. Understanding why it’s important to report these violations and how the process works can help maintain the integrity of...