Understanding and interpreting a tax bill can sometimes seem like deciphering a complex secret code. However, it is essential to comprehend the specifics of your tax bill to prevent any errors, avoid legal implications, and optimize your tax payments. This article aims to simplify the process by providing a comprehensive guide on how to interpret your tax bill, the importance of personalization, key tax terms you should know, and strategies to optimize your tax payments.

Understanding the Basics: What is a Tax Bill?

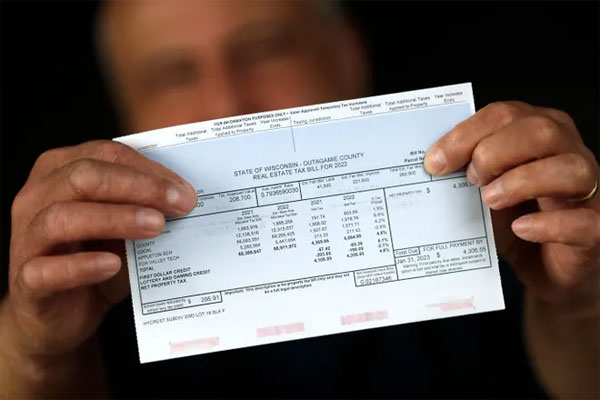

A tax bill is a statement sent by the government or a taxing authority to taxpayers detailing the amount of tax owed for a specific period. It comprises various components, each with a specific role in the overall calculation of your tax amount. It includes details of your taxable income, tax rates, tax credits, and deductions. Understanding the basics of a tax bill is the first step towards more effective tax management. Remember, tax bills are sent yearly, quarterly, or monthly, depending upon your income and local or federal tax regulations.

Deciphering the Details: Line by Line Explanation of Your Tax Bill

Understanding each line of your tax bill can be a daunting task, but it’s crucial for accurate tax planning. The first line usually states your gross income – the total income earned within the tax year. The next lines detail any deductions you’re entitled to, such as standard deductions, itemized deductions, or business expense deductions. The subsequent section explains your taxable income, which is your gross income minus any deductions. The final lines typically outline any credits you qualify for and the total tax you owe.

The Role of Personalization: How it Affects Your Tax Amount

Personalization plays a significant role in the calculation of your tax amount. Your tax amount isn’t just based on your income; several personal factors contribute to its calculation. These factors include your filing status (single, married filing jointly, etc.), number of dependents, type of work (self-employed, employee, etc.), and your location. These personal attributes help determine your tax bracket, and hence influence your tax liability.

Key Tax Terms You Should Know: Unraveling the Tax Jargon

The world of taxes features a language of its own. Understanding the following key tax terms can demystify the tax code and help you navigate your tax bill more effectively:

- Gross Income: The total income you’ve earned within the tax year before any deductions.

- Taxable Income: Your gross income minus any applicable deductions.

- Deductions: Certain expenses you can subtract from your gross income to lower your taxable income.

- Credits: Amounts you can subtract directly from your tax bill, unlike deductions that reduce your taxable income.

Smart Strategies: How to Optimize Your Tax Payments

Optimizing your tax payments involves strategic planning. Here are a few strategies to consider:

- Take advantage of tax deductions and credits: Ensure you’re utilizing all eligible deductions and credits to reduce your tax liability.

- Adjust your withholdings: If you continually owe taxes or are getting large refunds, consider adjusting your withholdings.

- Seek professional help: If your tax situation is complex, it might be worth seeking the help of a tax professional.

Recap and Next Steps: Navigating Your Tax Bill Like a Pro

Understanding your tax bill is about more than just knowing what you owe. It’s about understanding how your personal circumstances contribute to your tax obligations and how to strategically manage your tax payments to make the most of your income. Use this guide as a starting point in your journey to becoming adept at interpreting your tax bill. Remember to apply the strategies for tax optimization and don’t hesitate to seek professional help if needed.

In the end, interpreting your tax bill isn’t as daunting as it seems. With a clear understanding of the basics, a line-by-line explanation, knowledge of key tax terms, and effective strategies, you can navigate your tax bill like a pro. Remember that personalization plays a vital role in determining your tax amount and optimizing your tax payments is possible with the right strategies. Tax management is a crucial aspect of financial planning, and understanding your tax bill is the first step towards efficient tax management.